Inheritance tax? Estate tax? Death tax? Aren’t these all the same thing?

The short answer is no. These terms are often used interchangeably, but have very different implications for the recipient of an inherited asset.

An inheritance tax requires certain beneficiaries to pay a tax on specific assets they’ve inherited. This tax currently exists only at the state level, and collected in only six states: Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania.

An estate tax is the tax of an entire estate transferred from a deceased person to their chosen heir. These taxes are collected at both the state and federal level, but paid from the estate itself not the beneficiary. The tax rate depends on the property value and the sum of the assets. If it’s higher than the federal estate tax exemption, the property is subject to a federal estate tax. States have their own tax thresholds as well.

The inheritance tax is state imposed and upon the inheritor. The estate tax is a federal and state levied tax on the aggregate value of an estate prior to the bequeathing of an inheritance to an heir. Don’t worry, we’ll dive into the nitty gritty of inheritance taxes, and if you have any questions about it, we’re here to answer them.

Inheritance taxes at the state level

Inheritance tax

If you live outside of the aforementioned six states, then your state does not impose any inheritance tax. If your inheritance is coming from a different state and you live in one of the six states with an inheritance tax, you do not have to pay the state tax. If your benefactor lived in one of the six states, you may owe taxes to that state.

The inheritance tax rates vary depending on the beneficiary’s relationship with the deceased person whom they have inherited assets from. The rate is a gradient depending upon the nature of the heir’s relationship with the deceased.

If you are a surviving spouse, you are exempt from any inheritance taxes. Children of the deceased pay the lowest tax rate if at all. Some states exempt direct descendants. More distant relatives and non-relatives pay the highest tax rate on inheritances.

Estate tax

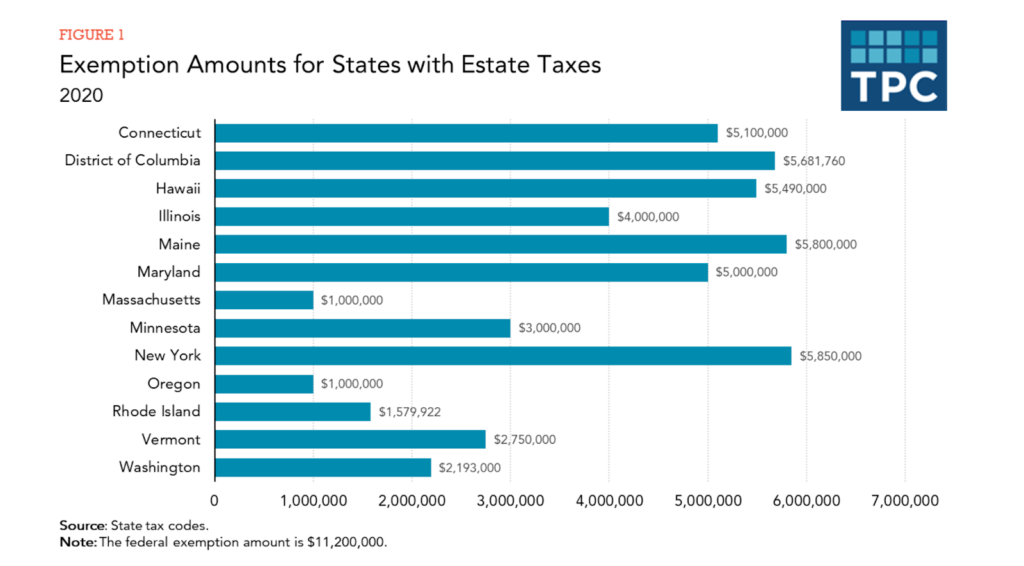

There are twelve states that have an estate tax, Maryland is the only state with both an inheritance and estate tax. Estate taxes are based on the value of an inheriter’s assets after debts have been paid, and must be paid prior to the heir inheriting the estate. See below each state’s estate tax exemptions.

Inheritance taxes at the federal level

Like we mentioned above, there is no federal inheritance tax. If someone leaves you a sum of cash, that cash is tax free. With the exception of a retirement account like an IRA or a 401(k), if one inherited an account such as those, that heir could be subject to income tax or an estate tax.

Both of which are federally levied. An estate can be generally defined as real estate, stock, and other assets. The federal estate tax is applied when an heir’s assets exceed $11.58 million for a single filer and $23.16 million for married couples, at the time of death, and the estate tax rate can range from 0 to 40 percent. The federal exemptions are for surviving spouses.

But do not fret, 99.8 percent of estates owe no estate taxes to the federal government.

The tax of more likely consequence for inheritors is the capital gain tax after inheriting assets and or property and the secondary sale of them.

Capital gains taxes are on the sum of money you gain from the sale of an asset or property. The difference between the sale price and the value of an asset is what you’d be taxed on. If you sell an asset for less than its value, there is no tax due.

How to avoid inheritance taxes

There are a variety of ways to avoid significant taxes on inheritances and estates. Two ways are annual gifts and setting up trusts for your future beneficiaries.

Annual gifts

Annual gifts are a great option for avoiding inheritance taxes. This is a sum of money from a given person from your inheritance in the form of a gift each year.

In 2020, anyone can give someone else up to $15,000 and avoid paying a federal gift tax. A married couple can give up to $30,000. Lifetime sums under $11.4 million are also exempt from gift taxes. These amounts change annually and are set by the IRS.

Gift taxes are imposed by the federal government on the asymmetric transfer of money, in which one party transfers money, property, assets to another person with nothing in return. So keep your gifts in the realm of exemptions to achieve your goal of avoiding taxes!

Create a trust

A trust allows the transfer of assets to a beneficiary after death without having to go through probate. Moreover shrinks the appearance of the size of the estate.

There are two types of trusts. A revocable trust and an irrevocable trust.

A revocable trust is a worthy investment, so benefactors can allocate their property and investments to their heirs without the concern of inheritance taxes. Whoever put their assets into it can take them back out.

An irrevocable trust is a permanent placement of assets and remains there until the person who established the trust passes.

It is an uncomfortable confrontation with our own mortality, but an important plan to have.

We Can Help Will All Your Tax Needs

Here are Considine and Considine we excel at retirement, estate and trust management. We can help you create a plan for your estate that is right for you and your family.

Get started today!